You May Not Want To Skip Over That House That’s Been Sitting on the Market

February 2026

When you see a house that’s been sitting on the market for a while, the reaction is almost automatic. You start thinking:

- What’s wrong with it?

- Why hasn’t anyone bought it yet?

- Am I missing something?

That mindset made sense a few years ago. But in today’s market, you may actually miss out.

More Time on Market Isn’t Automatically a Concern Anymore

A few years ago, homes sold in just a matter of days. Sometimes, hours. Anything that lingered longer than that raised concerns. But that’s no longer the baseline.

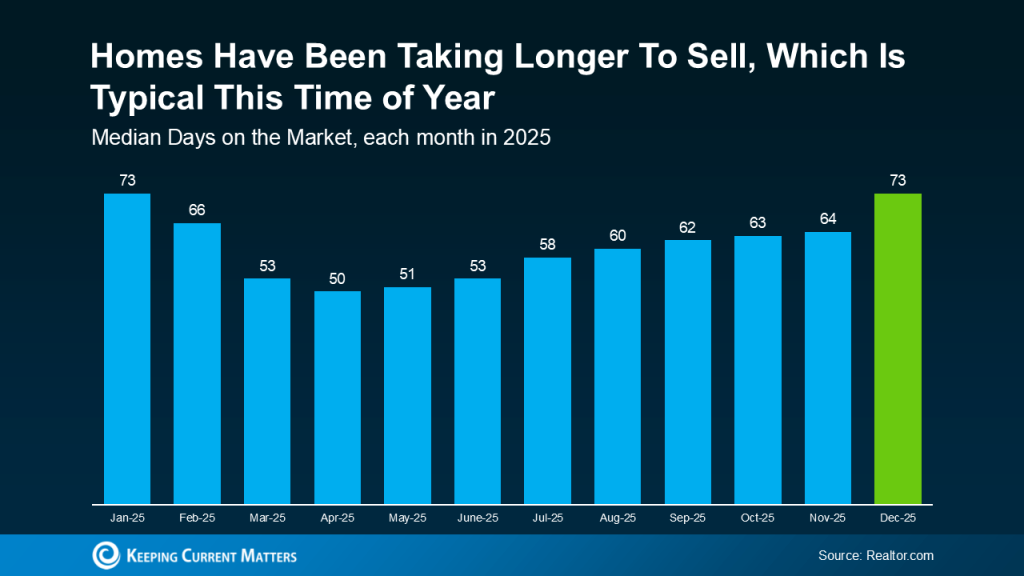

Inventory has grown. Buyers have more choices. And homes are taking longer to sell across the board. Those are some of the reasons why the typical time it takes a home to sell has climbed this year:

And it’s not that 73 days is slow. That’s actually pretty normal for this time of year. It just feels slow because you heard so much about houses being snapped up in the buying frenzy a few years ago.

That shift alone explains a lot of what you’re seeing. It’s not necessarily that there’s anything wrong with the house itself. Although, let’s be honest, sometimes that is the case.

Most of the time today, a house that’s taking longer to sell simply means:

- There are a lot of homes for sale in that area

- The seller priced a little too high at first

- The home didn’t photograph as well online

- Buyers passed it over for flashier listings nearby

- The timing just wasn’t right when it first hit the market

None of those are necessarily deal-breakers.

What Buyers Often Get Wrong About These Listings

Because even though you may assume a house that hasn’t sold must have hidden issues, the reality is, that’s not always the case. And, if the house does have issues, it’ll show up quickly in your inspection.

That’s information you can use to negotiate. Not a reason to walk away automatically. And in many cases, that’s where buyers find the best deals.

The key is knowing which homes that have been sitting for a while are worth a second look – and which ones aren’t. That’s why working with a local agent makes a real difference. They’ll be able to look at disclosures and more to help you uncover hidden gems other buyers may overlook.

Bottom Line

A home sitting on the market isn’t always a warning sign. Sometimes it’s an overlooked opportunity.

If you want help identifying which homes are worth a second look (and which ones to skip), talk to a local agent.

- Courtesy of Keeping Current Matters

Why More Homeowners Are Giving Up Their Low Mortgage Rate

January 2026

If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins - and it can be hard to let go. But here’s what you need to remember...

A great rate won’t make up for a home that no longer works for you. Life changes, and sometimes, your home needs to change with it. And you’re not the only one making that choice.

The Lock-In Effect Is Starting To Ease

Many homeowners have been frozen in place by something the experts call the lock-in effect. That's when you won't move because you don’t want to take on a higher rate on your next home loan. But data from Federal Housing Finance Agency (FHFA) shows the lock-in effect is slowly starting to ease for some people.

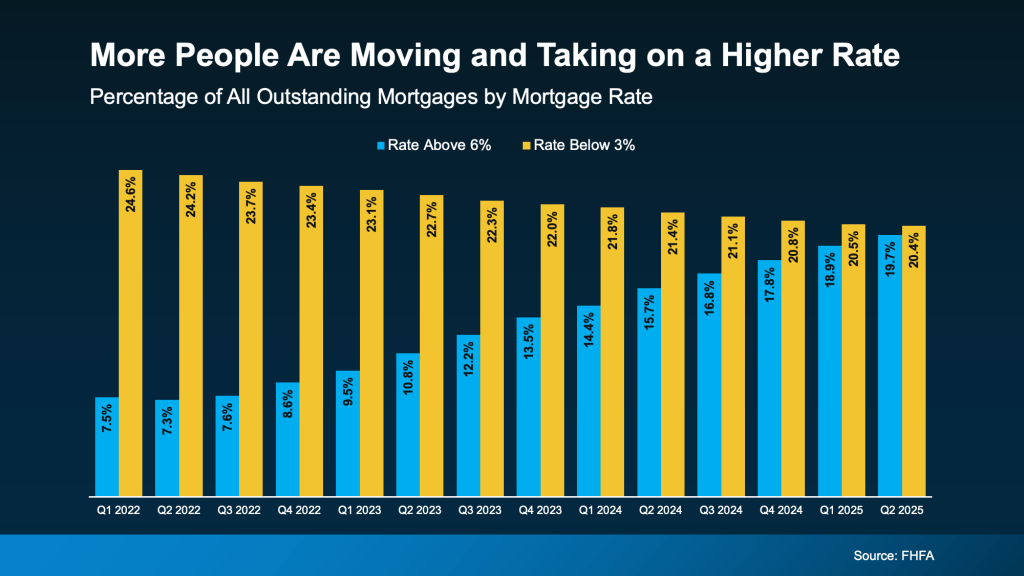

The share of homeowners with a mortgage rate below 3% (the yellow in the graph below) is slowly declining as more people move. And while some of the people with a rate over 6% are first-time buyers, the number of homeowners with a rate above 6% (the blue) is rising as others take on higher rates for their next home:

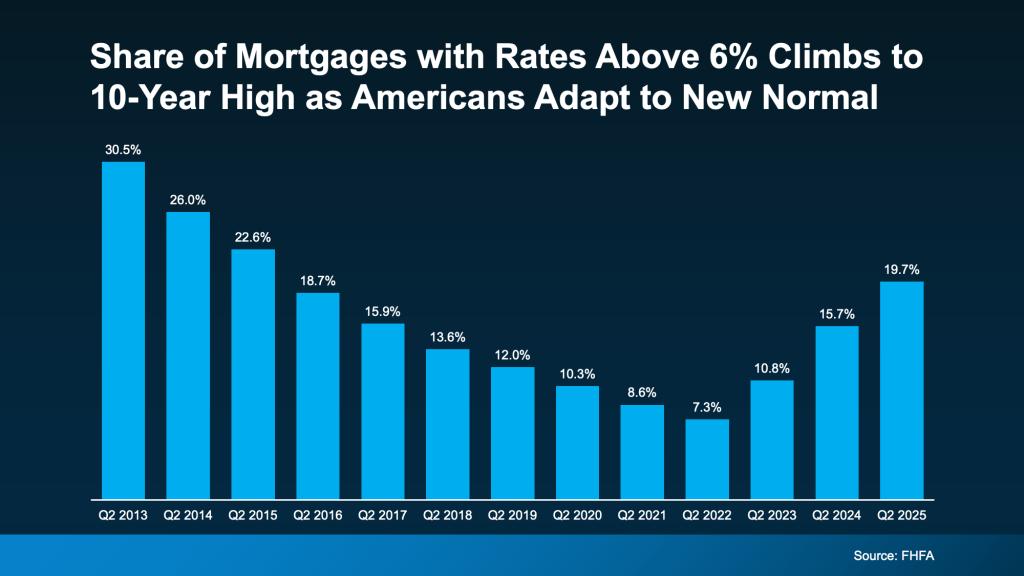

And while it may not seem that dramatic, it’s actually a pretty noteworthy shift. The share of mortgages with a rate above 6% just hit a 10-year high (see graph below). That shows more people are getting used to today’s rates as the new normal.

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

It’s simple. Sometimes they can’t put their life on pause anymore. Families grow, jobs change, priorities shift, and a house that once fit perfectly may not fit at all anymore – no matter how good their rate was. And that’s okay. As Chen Zhao, Head of Economic Research at Redfin, explains:

“More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate. Life doesn’t standstill - people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate.”

First American refers to these life motivators as the 5 Ds:

Diplomas: People with college degrees typically earn more, and that adds up to more buying power. Maybe you bought your house when you were younger and now that you’ve graduated and have a rising career, you’re ready to move up.

Diapers: You’ve outgrown your space. If you’re welcoming a new baby, your current home might not be cutting it anymore.

Divorce: Whether it’s ending a marriage (or starting one), it can create the need for a new place to call home.

Downsizing: You’re ready to downsize. Maybe the kids have moved out and it’s time to simplify. Smaller house, less maintenance, more freedom.

Death: If you’ve recently lost a loved one, maybe you’ve realized you want to be closer to family. Life’s too short to live far from the people who matter most.

Whatever your reason, here’s what you need to think about. Yes, your low rate is great. But staying put means your life may stay on hold. And maybe that’s not working for you anymore.

According to Realtor.com, nearly 2 in 3 potential sellers have already been thinking about moving for over a year. That’s a long time to press pause on your plans. On your needs. On your family’s goals. So, maybe the question isn’t: “Should I move?”

It’s actually: “How much longer am I willing to stay somewhere that no longer fits my life?”

Because we’ve already seen rates come down from their peak earlier this year. And they're expected to ease a bit more in 2026. When you stack that on top of the very real reasons you may need a new home, it may be enough to finally move the needle for you.

Bottom Line

Life doesn’t wait for the perfect rate. Maybe you shouldn’t either.

With mortgage rates down from their peak and forecast to dip slightly more in 2026, moving may be more feasible than you think. If you’re ready to see what’s possible in our market, let’s talk.

- Courtesy of Keeping Current Matters

Most Experts Are Not Worried About a Recession

December 2025

Homebuyers are watching the economy closely, and for good reason. Buying a home is one of the biggest purchases most people ever make. And some recession talk in the media has made a lot of would-be buyers second guess their plans.

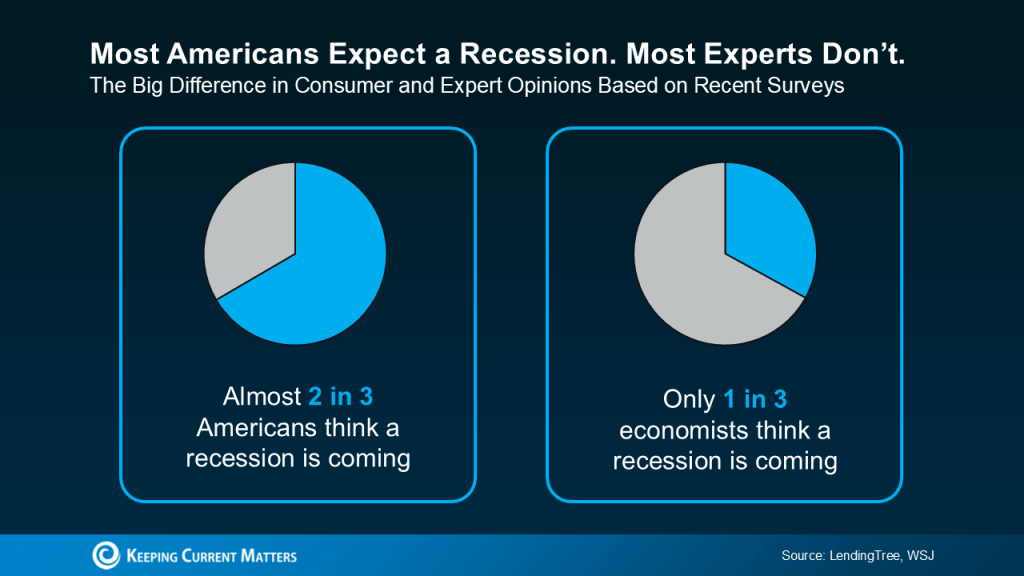

In the latest LendingTree survey, almost 2 in 3 Americans said they think a recession is coming. And 74% of respondents say that’s having an impact on their financial decisions.

But here’s the good news: the experts aren’t nearly as concerned.

Most Americans Expect a Recession, But Most Experts Don’t

According to an October report from the Wall Street Journal (WSJ), only 1 in 3 experts surveyed say we may be headed for a recession sometime in the next 12 months.

If the expert economists aren’t super worried, should you be? We’re not in a recession right now. And there’s no guarantee we’re heading into one.

What we do have is uncertainty - and the best way to handle that is by leaning on facts, not fear. You can do that by making sure you have the information you need to make an informed decision.

Tips for Buying a Home During Periods of Economic Uncertainty

Here’s the best advice anyone can give right now. While it’s important to keep an eye on what’s happening in the economy, that shouldn’t necessarily overshadow your real-life needs. Economic shifts come and go, but the reasons people buy homes rarely change. Danielle Hale, Chief Economist at Realtor.com, explains:

“Well-prepared buyers who have been waiting on the sidelines are likely motivated by personal and lifestyle needs like growing families, new jobs, or retirement. And these considerations can outweigh short-term economic uncertainties… ”

Timing your move around real life (not the news cycle) is what matters most.

But here’s the key. If you’re going to buy a home right now, job stability really matters. You need to feel confident in your income and know you can comfortably manage your mortgage payments, even if your situation or the economy shift.

If your job is secure and you’ve built a cushion of savings, experts say you don’t necessarily need to delay. Just keep these tips from the economists at Redfin in mind:

- Set a budget and stick to it: Don’t overextend. Make sure your payments are affordable and your savings can cover any surprises. This includes factoring in costs likely to rise, like home insurance and taxes.

- Negotiate: There are more homes for sale right now, and other buyers may pull back because of their own fears. That gives you more negotiating power when working with sellers. Use it to get the best deal possible.

- Be strategic about payments and mortgage rates: Talk to lenders about what payment you can afford and the rate you can qualify for today, as well as your options if rates go down later on.

- Consider selling before you buy: If you already own a home, selling first can reduce the financial pressure and help solidify your budget for your next home.

But nothing replaces the value of having a trusted team around you, especially right now. As Bankrate says:

“Buying a home during a recession can sometimes be a good idea – but only for people who are lucky enough to remain financially stable… Be sure to enlist the help of an experienced local real estate agent. Not only do agents know their markets well, they will also work to get you the best deal in any given situation, including a recession.”

Bottom Line

Most Americans think a recession is coming. But most experts don’t.

So, you don’t necessarily have to put your moving plans on hold. If your finances are solid, your job is stable, and you have a real need to move, you can still make this happen. You just need the right team of pros by your side.

- Courtesy of Keeping Current Matters

Thinking About Renting Your House Instead of Selling? Read This First.

November 2025

If your house is on the market but you haven’t gotten any offers you’re comfortable with, you may be wondering: what do I do if it doesn’t sell? And for a growing number of homeowners, that’s turning into a new dilemma: should I just rent it instead?

There’s a term for this in the industry, and it’s called an accidental landlord. Here’s how Yahoo Finance defines it:

“These ‘accidental landlords’ are homeowners who tried to sell but couldn’t fetch the price they wanted - and instead have decided to rent out their homes until conditions improve.”

Why This Is Happening More Often Right Now

And right now, the number of homeowners turning into accidental landlords is rising. Business Insider explains why:

“While there have always been accidental landlords . . . an era of middling home sales brought on by a steep rise in borrowing rates — is minting a new wave of reluctant rental owners.”

Basically, sales have slowed down as buyers struggle with today’s affordability challenges. And that’s leaving some homeowners with listings that sit and go stale. And if they don’t want to drop their price to try to appeal to buyers, they may rent instead.

But here’s the thing you need to remember if renting your house has crossed your mind. Becoming a landlord wasn’t your original plan, and there’s probably a reason for that. It comes with a lot more responsibility (and risk) than most people expect.

So, if you find yourself toying with that option, ask yourself these questions first:

1. Does Your House Have Potential as a Profitable Rental?

Just because you can rent it doesn’t mean you should. For example:

- Are you moving out of state? Managing maintenance from far away isn’t easy.

- Does the home need repairs before it’s rental-ready? And do you have the time or the funds for that?

- Is your neighborhood one that typically attracts renters, and would your house be profitable as one?

If any of those give you pause, it’s a sign selling might be the better move.

2. Are You Ready To Be a Landlord?

On paper, renting sounds like easy passive income. In reality, it often looks more like this:

- Midnight calls about clogged toilets or broken air conditioners

- Chasing down missed rent payments

- Damage you’ll have to fix between tenants

As Redfin notes:

“Landlords have to fix things like broken pipes, defunct HVAC systems, and structural damage, among other essential repairs. If you don’t have a few thousand dollars on hand to take care of these repairs, you could end up in a bind.”

3. Have You Thought Through the True Costs?

According to Bankrate, here are just a few of the hidden costs that come with renting out your home:

- A higher insurance premium (landlord insurance typically costs about 25% more)

- Management fees (if you use a property manager, they typically charge around 10% of the rent)

- Maintenance and advertising to find tenants

- Gaps between tenants, where you cover the mortgage without rental income coming in

All of that adds up, fast.

While renting can be a smart move for the right person with the right house, if you’re only considering it because your listing didn’t get traction, there may be a better solution: talking to your current agent and revisiting the pricing strategy on your house first.

With their advice you can rework your strategy, relaunch at the right price, and attract real buyers to make the sale happen.

Bottom Line

Before you decide to rent your house, make sure to carefully weigh the pros and cons of becoming a landlord. For some homeowners, the hassle (and the expense) may not be worth it.

- Courtesy of Keeping Current Matters

State of the Market

October 2025

The government shutdown is a big turn of events. While this does have an economic impact and thereby the real estate market, I am not going to make any projections this month. For now, I am going to geek out on the information we do have.

Earlier this month I posted the results of the defining NOVA survey. Participation was not as robust as I had hoped but I found it interesting nonetheless. For the sake of continuity, this market update includes Alexandria, Arlington, Fairfax, Loudoun, and Prince William Counties. I might widen the scope in the future.

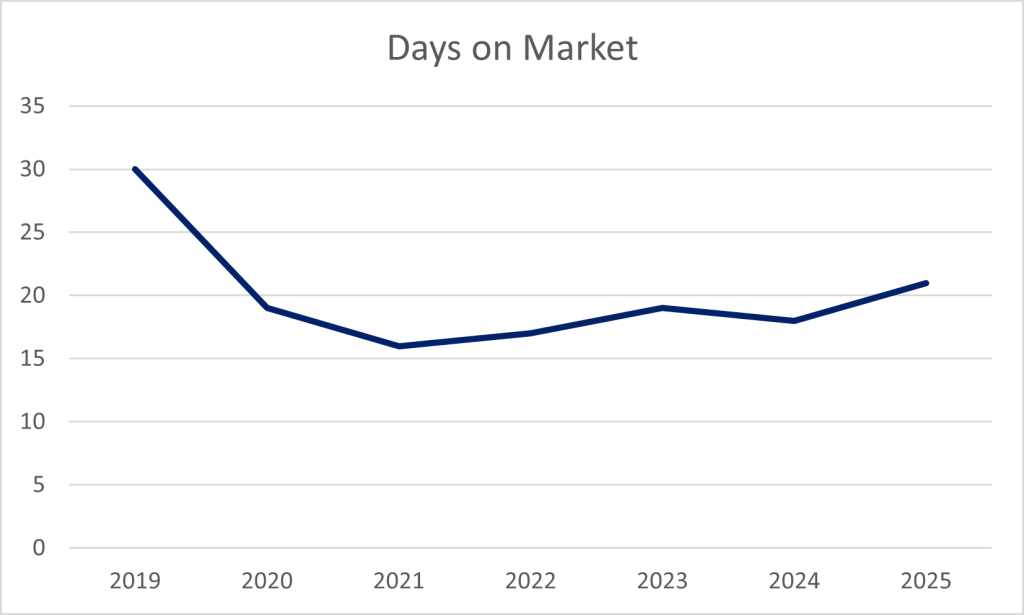

You may have heard homes are sitting for longer and it’s true. The current average days on market (DOM) is 21. In 2019 the DOM was 30. Since that time the biggest variance was in 2021, which averaged 16 days. Houses are on the market longer this year…but not by much.

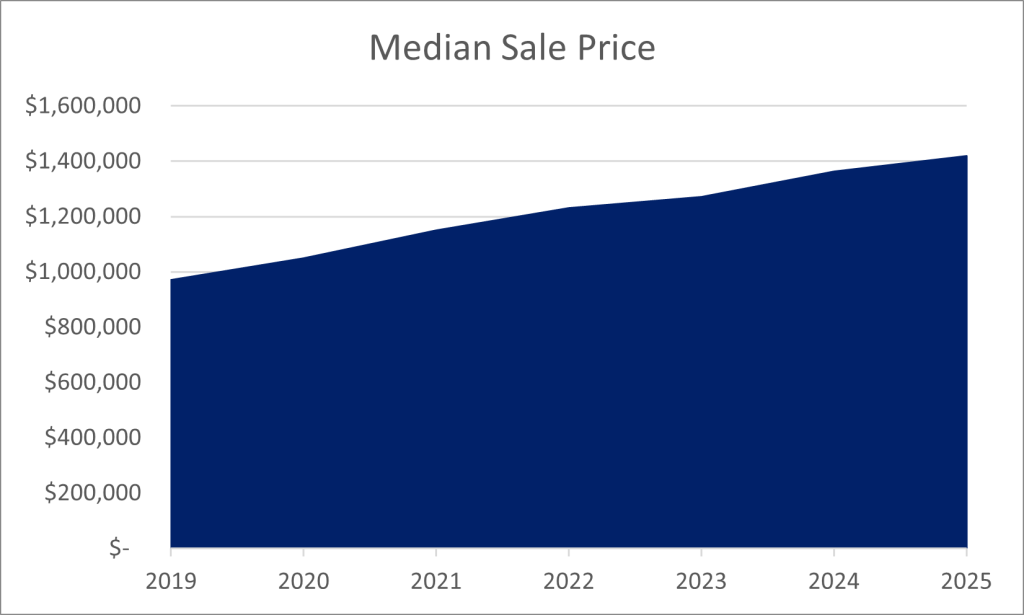

You may have also heard many list prices are being reduced. This is also true. For the past few years home prices have increased dramatically year-over-year. The difference this year is there has been less of a spike. Based on 2025 data (through September), the 2025 median sale price is still $30,000 higher than all of 2024. It is very likely those homes were not initially priced according to the current conditions nor specific location. (Remember the “Swiss cheese” blog? You can find it here.)

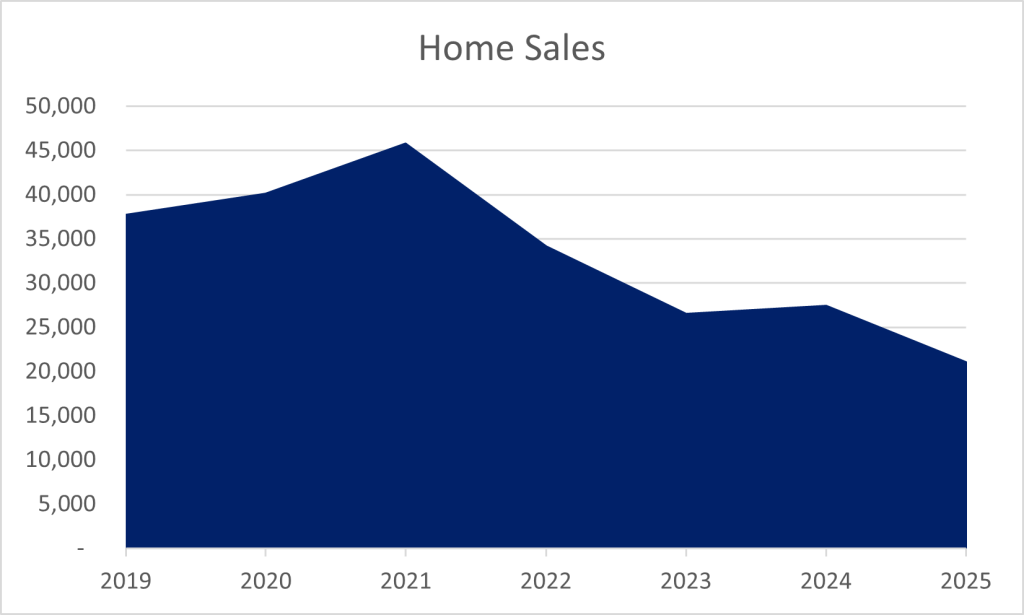

The biggest shift this year is the decline in number of sales. I am confident the remainder of 2025 will not accumulate the same activity as 2023 or 2024, and sales activity during those years was considered low.

So…throughout NOVA it is taking a little longer for homes to receive an offer yet prices are stable, despite a drop in the number of sales. This indicates a lack of demand.

Aside from economic uncertainty, the general consensus among colleagues is buyers are fatigued.

- The reason buyers have been able to afford the price increases is because the rates were historically low. Even with a recent dip, rates are higher than just a few years ago yet prices continue to increase.

- For some time, buyers were waving their due diligence, even purchasing homes sight unseen. Virginia is a caveat emptor (“buyer beware”) state. Buyers want to exercise their rights to learn about the home. They want fair contract terms.

- Buyers compensating their agents now need significantly more cash to close. This cash could have been reserved for repairs they once overlooked or buying down their mortgage loan rate, presuming the additional cash is even available.

I believe we have pushed buyers as much as we can given the market volatility. There is only so much juice in a lemon. I also believe economic uncertainty cannot be underestimated.

Lastly, it is important to note these charts are solely comprised of on-market sales reported in the multiple listing service. In April’s newsletter, Spring has sprung!, I explained the new rules for off-market sales. As of now, there is no data about those sales. There is no clock counting the days, nothing tracking list and sale prices, no indication of loan types or concessions. I learn of at least one off-market listing every day through networking. Despite all of the marketing and contact, I suspect if all sale information were available, 2025 sales would not equate or exceed prior years, and I am confident buyers are tired. It has been quite a year!

What Defines Northern Virginia?

October 2025

About three weeks ago, I circulated a survey with a list of counties asking recipients to select the counties they believe comprise Northern Virginia. The following table provides the results:

| City of Alexandria | 88% |

| Arlington County | 84% |

| Fairfax County | 94% |

| Fauquier County | 25% |

| Frederick County | 19% |

| Loudoun County | 97% |

| Prince William County | 84% |

| Spotsylvania County | 6% |

| Stafford County | 3% |

| Other* | 6% |

Of the 162 responses, not one county achieved 100% agreement from the participants. This surprised me most. It has left me wondering if I should have used a different tool or if the instructions were unclear. The poll was small given the population in our area. Perhaps I should have given it more time. Regardless, I found the results enlightening, particularly for Fauquier and Frederick Counties.

*King George and Clarke Counties

Do the results surprise you? Do you think they are a true reflection of NOVA? Drop me a line. I would love to hear your thoughts.

Selling and Buying at the Same Time? Here’s What You Need To Know

September 2025

If you’re a homeowner planning to move, you’re probably wondering if it is better to start by finding your next home or if you should you sell your current house before you go out looking.

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1) You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2) You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3) You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1) You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

Here’s a simple visual that can help you think through your options:

Bottom Line

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you're ready to make a move but not sure where to begin, talk to a local agent. They'll walk you through your equity, your timing, and your local market so you can decide what’s right for you.

- Courtesy of Keeping Current Matters

Instant Offers and iBuyers

August 2025

With advances in technology and new ways to utilize data, some companies have sprouted up to create different ways to sell your property. Basically, they utilize automated valuation models (AVMs) to make quick offers on homes, allowing them to close in a much faster than typical timeframe, and then resell them. From a seller's standpoint, it can eliminate some hassle and uncertainty, but with high "transaction fees" ranging from 7% to 14%, and the likelihood that they will sell the home for more than they paid you for it, you are simply exchanging that smooth and quick transaction for a portion of your equity.

Companies that offer this kind of service are only in limited markets across the country right now. They operate by having homeowners fill out a short questionnaire with information on their home. They feed that data into their AVM, which kicks back an offer price. They make the homeowner a cash offer to close in a short timeframe (typically about a week) and specify what the fee will be to proceed through to closing. Once they own the home, they will repair and spruce it up, and list it for sale on the open market.

It may be tempting to consider such an offer, but keep in mind that this is a straight numbers play. They are determining a price that allows them the room to cover the costs of the transactions as well as the repairs, while still making some profit. Their profit will either come from the fee you've paid or from acquiring your home at a below market price – although it could possibly be a combination of the two. An analysis on one company's transactions showed they were selling homes at an average 5.5% appreciation, on top of their transaction fee. That's a lot of money to leave on the table for a little convenience.

There are other companies beginning to test alternative listing models as well, utilizing technology and AVMs to make 'instant offers' on homes, or to help buyers acquire and move into their next home before selling their current one. As always, it's important to read the fine print and understand what you are agreeing to, if one of these companies expands into your area.

- Courtesy of Cloud CMA

Hello Summer

June 2025

What. A. Spring. The last few months have been a ride! Someone described the Northern Virginia real estate market as a slice of Swiss cheese and it could not be more accurate. With the continuous changes in the policies (i.e. off-market listings), economic uncertainty, and questionable data, it is difficult to sum up the spring market.

When people ask me if we are still seeing bidding wars, the answer is yes. When I am asked if houses are sitting for longer, the answer is also yes. We’re seeing a greater number of price reductions and homes sitting for several weeks, while others are on the market for just a few days and close above list price. Ironically, we can find both on the same street!

I am not yet ready to predict how the first five months of 2025 will influence the second half of the year, but I do have some statistics that are a great snapshot of recent trends. Ekko Title, a local, reputable title company has several offices throughout Northern VA. They periodically posts a summary of their 10 most recent transactions per office. The following information was shared this past week.

The snapshot Ekko provides is the greatest insight into trends around the region and cannot be found among the typical, more general data.

Based on the numbers in the table, 18 of the 40 transactions closed below list price and most sellers paid for the buyer’s representation. Both reduce a seller’s net proceeds.

Just 19 of the 40 purchases included a home inspection contingency, the primary way to gather information about the condition of a home. (Prior to a few years ago opting out of a home inspection was unheard of. Now it is a tactic to strengthen an offer.)

If prices are reduced and sellers are paying concessions, why are buyers still sacrificing their due diligence? The contradiction makes it difficult to conclude if the current market favors buyers or sellers. I believe we are teetering in between and the answer is subject to interpretation. As always, the location, type of home, and price range yield very different stories. I hope to have a more solid slice (😉) of understanding in the months to come.

One of my favorite annual events is coming soon! Registration for the Appraisal Road Show will begin soon. If you would like to have an heirloom appraised, bring it along and enjoy lunch and entertainment while benefitting one of my favorite organizations, the Shepherd’s Center of Northern Virginia.

I hope your summer is off to fun start and you are able to enjoy time off from school, trips to the beach, and celebrate the season with friends and family. If there is anything I can do to support you, please don’t hesitate to reach out.

Spring has sprung!

April 2025

The spring real estate season has been as chaotic as the weather but not for the reasons you might suspect. Bright MLS, our local multiple listing service, made some changes and it has altered how we list and locate properties for sale. The following is one example of why this spring is different.

Former Rule: Off-market listings could only be marketed within the listings agent’s brokerage. The listings were not entered into the MLS and could not be advertised publicly. One of the intentions of this rule was to ensure all buyers had access to all available homes for sale thus upholding Fair Housing Laws.

There are several scenarios when selling off-market makes sense. The former rules presented a challenge, and off-market sales were not common, but I can attest it was possible. In addition, buyers using the MLS to identify homes of interest could rely on the MLS to contain the vast majority of options and transparency.

2024: All off-market sales must be reported in Bright MLS and would have limited visibility. Essentially this was a new reporting requirement. It did not influence market activity.

2025: With seller direction, listing agents can publicly advertise an off-market listing without entering it into the MLS. Off-market homes for sale are openly marketed via social media, email, and networking, etc. regardless of brokerage...essentially anywhere except the MLS and thereby all commercial sites (i.e. realtor.com, zillow.com) it feeds.

Problem: There is no primary source of information. Transactions are happening and not tracked. There is little oversight of laws and regulations, and buyers are no longer aware of all the options. Buyers can be handpicked by sellers, which is the antithesis of Fair Housing.

In addition, buyers and sellers are making decisions based on incomplete information, potentially costing them valuable time, money, and effort. A lack of accurate data could also pose challenges for appraisals.

Marketing to the masses has always, and still does, result in a greater return for sellers. I strongly urge sellers to go “all in” unless a health and/or safety concern prevails. Having access to all listings not only sustains the protections established for buyers, but it also gives them confidence to make offers. Uncertainty often stunts action and inaction stunts sales.

A little reminder…a recession does not equate to a real estate market crash. Nor is there a prediction of a crash in Northern Virginia. It is too premature to assess if/how returning to the office and government layoffs will influence our local market. Hopefully we will have enough reliable data this summer to formulate valuable conclusions. If you are wondering how the changes could impact your goals, call me. I am happy to discuss your personal situation and help you formulate a plan.