State of the Market

October 2025

The government shutdown is a big turn of events. While this does have an economic impact and thereby the real estate market, I am not going to make any projections this month. For now, I am going to geek out on the information we do have.

Earlier this month I posted the results of the defining NOVA survey. Participation was not as robust as I had hoped but I found it interesting nonetheless. For the sake of continuity, this market update includes Alexandria, Arlington, Fairfax, Loudoun, and Prince William Counties. I might widen the scope in the future.

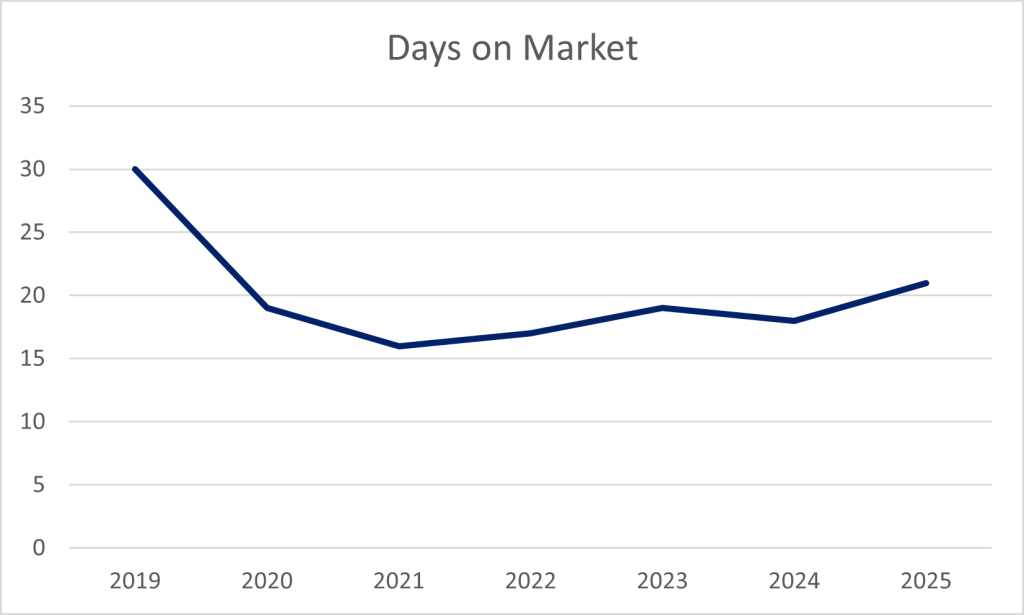

You may have heard homes are sitting for longer and it’s true. The current average days on market (DOM) is 21. In 2019 the DOM was 30. Since that time the biggest variance was in 2021, which averaged 16 days. Houses are on the market longer this year…but not by much.

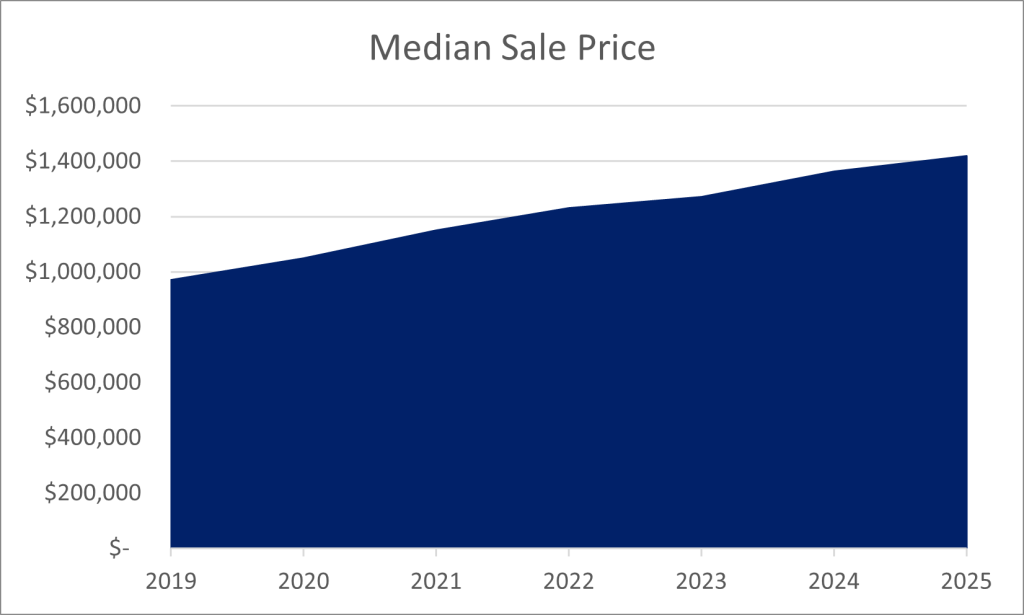

You may have also heard many list prices are being reduced. This is also true. For the past few years home prices have increased dramatically year-over-year. The difference this year is there has been less of a spike. Based on 2025 data (through September), the 2025 median sale price is still $30,000 higher than all of 2024. It is very likely those homes were not initially priced according to the current conditions nor specific location. (Remember the “Swiss cheese” blog? You can find it here.)

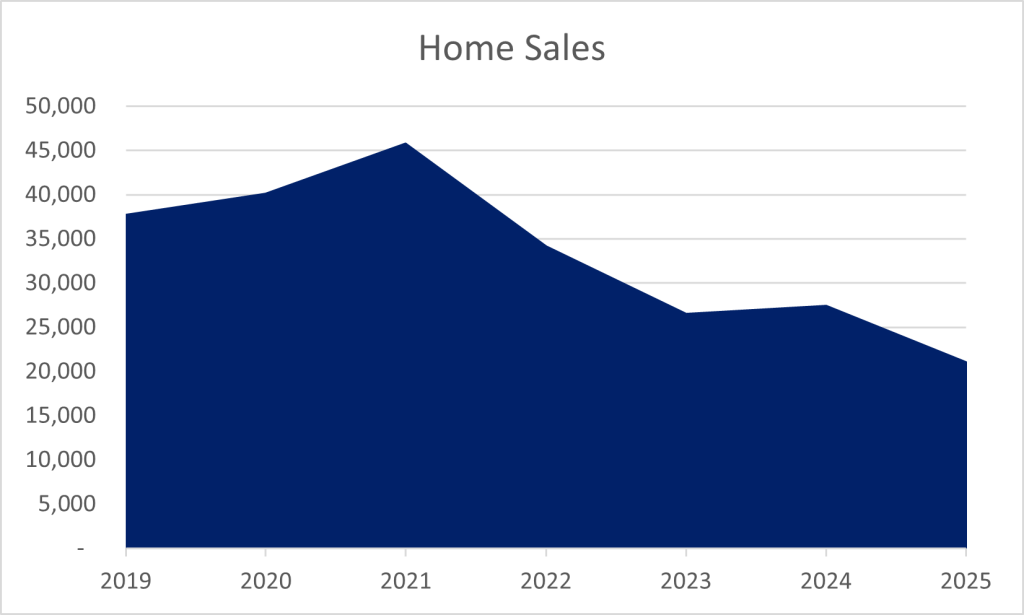

The biggest shift this year is the decline in number of sales. I am confident the remainder of 2025 will not accumulate the same activity as 2023 or 2024, and sales activity during those years was considered low.

So…throughout NOVA it is taking a little longer for homes to receive an offer yet prices are stable, despite a drop in the number of sales. This indicates a lack of demand.

Aside from economic uncertainty, the general consensus among colleagues is buyers are fatigued.

- The reason buyers have been able to afford the price increases is because the rates were historically low. Even with a recent dip, rates are higher than just a few years ago yet prices continue to increase.

- For some time, buyers were waving their due diligence, even purchasing homes sight unseen. Virginia is a caveat emptor (“buyer beware”) state. Buyers want to exercise their rights to learn about the home. They want fair contract terms.

- Buyers compensating their agents now need significantly more cash to close. This cash could have been reserved for repairs they once overlooked or buying down their mortgage loan rate, presuming the additional cash is even available.

I believe we have pushed buyers as much as we can given the market volatility. There is only so much juice in a lemon. I also believe economic uncertainty cannot be underestimated.

Lastly, it is important to note these charts are solely comprised of on-market sales reported in the multiple listing service. In April’s newsletter, Spring has sprung!, I explained the new rules for off-market sales. As of now, there is no data about those sales. There is no clock counting the days, nothing tracking list and sale prices, no indication of loan types or concessions. I learn of at least one off-market listing every day through networking. Despite all of the marketing and contact, I suspect if all sale information were available, 2025 sales would not equate or exceed prior years, and I am confident buyers are tired. It has been quite a year!